Expanding into new international markets brings exciting opportunities but also complex payroll, compliance, and tax challenges. Businesses must develop a resilient global payroll strategy that ensures compliance, cost efficiency, and seamless employee payments.

This blog explores the key components of a strong global payroll strategy and how businesses can optimize their payroll operations while expanding.

1. The Need for a Robust Global Payroll Strategy

When companies expand across multiple countries, they face:

✔ Diverse Labor Laws – Every country has unique tax codes, social security requirements, and labor laws.

✔ Payroll Compliance Risks – Mistakes in tax withholding or reporting can lead to hefty fines and legal issues.

✔ Cross-Border Payment Complexities – Managing multiple currencies, banking restrictions, and exchange rates.

✔ Data Security & Employee Confidentiality – Countries have strict regulations like GDPR (Europe), PIPL (China), and HIPAA (U.S.).

Without a well-defined payroll strategy, businesses risk delays in employee payments, compliance penalties, and reputational damage.

2. Key Elements of a Resilient Global Payroll Strategy

A. Compliance-First Approach

✔ Stay updated with local tax regulations, employment laws, and reporting deadlines.

✔ Implement an automated compliance system that ensures accurate payroll processing.

✔ Partner with a Global Employer of Record (EOR) for compliance management.

💡 Example: Companies operating in Europe must comply with GDPR while handling employee data, ensuring secure payroll processing.

B. Centralized Payroll Management

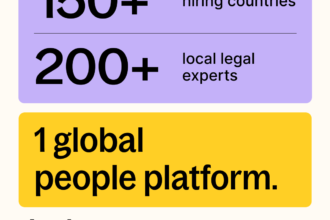

✔ Use a single payroll system that manages multi-country payroll from one platform.

✔ Ensure standardized payroll processes across all locations.

✔ Integrate payroll with HR, accounting, and compliance software.

💡 Example: Businesses with employees in Asia, North America, and Europe benefit from a centralized cloud payroll system that handles different tax structures.

C. Multi-Currency & Cross-Border Payment Solutions

✔ Choose a payroll provider that supports multi-currency payments.

✔ Automate currency conversion and real-time payments.

✔ Reduce high transaction fees by using global payment networks.

💡 Example: Payroll providers like Deel and Papaya Global offer multi-currency payment options for international employees and contractors.

D. Payroll Automation & AI-Driven Insights

✔ Use AI-powered payroll systems for accurate salary calculations.

✔ Automate tax deductions, social security contributions, and benefits management.

✔ Leverage AI analytics to forecast payroll costs and optimize workforce planning.

💡 Example: AI-driven payroll systems detect anomalies in tax calculations, preventing overpayments or underpayments.

3. Benefits of a Strong Global Payroll Strategy

✔ Ensures Full Compliance – Reduces legal risks and regulatory penalties.

✔ Enhances Employee Satisfaction – Employees receive timely and error-free salary payments.

✔ Saves Time & Costs – Automation reduces manual errors and streamlines payroll processing.

✔ Improves Decision-Making – AI-driven payroll analytics provide financial insights for business expansion.

4. The Future of Global Payroll Strategies

As global business landscapes evolve, companies must embrace:

✔ Blockchain Payroll Solutions – Secure and transparent smart contract-based salary payments.

✔ Instant Payroll Processing – Real-time, cross-border payments for employees and contractors.

✔ AI-Driven Payroll Audits – Automated compliance audits to reduce tax risks and fraud.

Conclusion

A resilient global payroll strategy is essential for businesses expanding across borders. By leveraging automation, AI, and centralized payroll systems, companies can ensure compliance, efficiency, and cost-effective payroll management.