Expanding your business internationally comes with the challenge of managing global payroll across multiple countries. Each country has different tax laws, payroll regulations, and compliance requirements, making payroll processing complex. Choosing the right global payroll provider is critical to ensuring smooth, compliant, and efficient payroll management.

In this blog, we’ll explore key factors to consider when selecting a global payroll provider and how to find the best fit for your business needs.

1. Understanding Your Global Payroll Needs

Before choosing a provider, evaluate your company’s payroll requirements:

✔ Number of Countries – Identify the regions where you need payroll processing.

✔ Employee Types – Determine if your workforce consists of full-time employees, contractors, or a mix of both.

✔ Compliance Requirements – Consider specific tax regulations, social security contributions, and local labor laws.

✔ Integration Needs – Assess whether the payroll system should integrate with your existing HR, accounting, and ERP systems.

2. Key Features to Look for in a Global Payroll Provider

When selecting a provider, look for these essential features:

✔ Compliance Expertise – The provider should have deep knowledge of local payroll laws, tax filing requirements, and labor regulations in different countries.

✔ Multi-Country Payroll Processing – Ensure the provider can handle payroll across multiple jurisdictions, currencies, and languages.

✔ Automated Tax Calculations & Filings – A good provider should automate payroll tax deductions, social contributions, and filings to reduce errors.

✔ Data Security & GDPR Compliance – Since payroll data is sensitive, ensure the provider follows strict data protection regulations (GDPR, SOC 2, ISO 27001).

✔ Scalability – Choose a provider that can grow with your business and support payroll in new markets as you expand.

✔ Integration with HR & Finance Systems – Payroll should seamlessly integrate with HR software, time tracking tools, and accounting systems.

3. Comparing Different Global Payroll Models

There are different types of payroll providers based on business needs:

| Payroll Model | Best For | Key Benefits | Considerations |

|---|---|---|---|

| Global Payroll Software (SaaS) | Large corporations with in-house HR teams | Automation, compliance tracking, cost-effective | Requires in-house payroll expertise |

| Employer of Record (EOR) | Companies hiring employees without a local entity | Full compliance, handles employment contracts & benefits | Higher costs per employee |

| Payroll Outsourcing Services | Companies without payroll expertise | End-to-end payroll management, tax filing | Less control over processes |

| Hybrid Solutions | Companies needing flexibility | Mix of automation & expert support | Customization required |

4. Questions to Ask a Potential Global Payroll Provider

Before signing a contract, ask the provider these critical questions:

✔ Which countries do you cover?

✔ Do you offer automated tax compliance and filings?

✔ What security measures do you have for payroll data?

✔ How do you handle currency conversions and exchange rates?

✔ Can you integrate with our existing HR & accounting tools?

✔ What is your customer support response time?

5. Top Global Payroll Providers in 2024

Some of the leading global payroll service providers include:

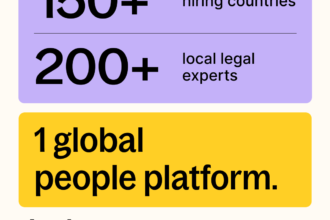

- Deel – Best for hiring remote employees and contractors.

- Papaya Global – Best for automated compliance and AI-driven payroll.

- Multiplier – Best for full-service payroll and EOR support.

- ADP Global Payroll – Best for enterprise-level payroll management.

Conclusion

Choosing the right global payroll provider is crucial for ensuring compliance, reducing payroll errors, and managing a global workforce efficiently. By evaluating your business needs, comparing different payroll models, and selecting a provider with strong compliance and automation capabilities, you can streamline international payroll operations and focus on business growth.