Expanding into global markets brings opportunities for business growth but also introduces complexities in taxation and regulatory compliance. Each country has its own tax laws, reporting requirements, and compliance standards that businesses must navigate to avoid legal and financial risks.

In this blog, we’ll explore the key taxation and compliance challenges in global markets and provide best practices to help businesses stay compliant while operating across multiple jurisdictions.

Key Taxation Challenges in Global Markets

1. Understanding Corporate Tax Rates and Structures

Different countries have varying corporate tax rates, deductions, and exemptions. Companies must ensure they comply with local tax regulations to avoid penalties. Some regions, like Ireland and Singapore, offer low corporate tax rates, while others have complex taxation structures.

2. Managing VAT, GST, and Sales Taxes

Global businesses must handle Value Added Tax (VAT), Goods and Services Tax (GST), and other sales taxes that vary by country. Compliance requires proper tax collection, reporting, and remittance to local tax authorities.

3. Cross-Border Taxation and Double Taxation Agreements (DTAs)

Companies operating in multiple countries may be subject to double taxation, where the same income is taxed in two jurisdictions. Many countries have DTAs to prevent double taxation, but businesses must navigate these agreements strategically.

4. Transfer Pricing Compliance

Multinational companies must ensure that intercompany transactions, such as goods, services, and intellectual property transfers, comply with transfer pricing regulations to prevent tax avoidance accusations.

5. Payroll Tax and Employee Benefits Compliance

Each country has specific payroll tax requirements that include social security contributions, income tax deductions, and employee benefits. Employers must handle these correctly to ensure compliance and avoid legal risks.

Key Compliance Challenges in Global Markets

1. Local Labor Laws and Employment Regulations

Employment laws cover areas such as working hours, termination policies, employee protections, and benefits. Non-compliance with these laws can lead to fines, legal disputes, or business restrictions.

2. Data Privacy and Security Regulations

Countries have strict data protection laws, such as GDPR in Europe, CCPA in California, and China’s Personal Information Protection Law (PIPL). Businesses handling customer or employee data must ensure full compliance.

3. Industry-Specific Regulations

Certain industries, like finance, healthcare, and e-commerce, have additional compliance requirements related to licensing, reporting, and consumer protection laws. Companies must stay updated on industry-specific rules.

4. Foreign Exchange and Banking Regulations

International transactions are subject to foreign exchange controls, anti-money laundering (AML) regulations, and banking compliance. Businesses must comply with local banking laws to process payments efficiently.

Best Practices for Ensuring Global Tax and Compliance Success

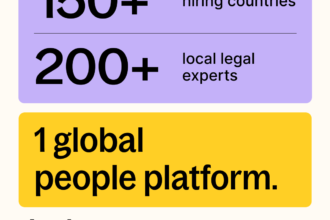

✔ Work with Local Tax Experts – Partner with tax professionals or accounting firms familiar with local regulations.

✔ Leverage Global Payroll and Compliance Solutions – Use automated tools to manage payroll tax and compliance efficiently.

✔ Monitor Regulatory Updates – Stay informed about changes in tax laws and compliance requirements.

✔ Use an Employer of Record (EOR) for Compliance Support – An EOR can handle tax compliance, payroll, and employee benefits in foreign markets.

✔ Maintain Proper Documentation and Reporting – Keep accurate records of tax filings, payroll transactions, and compliance activities.

Conclusion

Taxation and compliance in global markets can be complex, but with the right strategies, businesses can mitigate risks, ensure compliance, and operate smoothly across multiple countries. By leveraging expert guidance, compliance tools, and local partnerships, companies can successfully expand while avoiding costly legal and financial pitfalls.