As businesses expand into international markets, managing payroll across multiple countries becomes a complex challenge. From compliance with local tax laws to handling multi-currency payments, companies must ensure seamless payroll operations to avoid legal risks and financial penalties. Global payroll solutions play a crucial role in simplifying this process, ensuring compliance, and streamlining workforce payments worldwide.

Key Challenges in International Payroll Management

1. Compliance with Local Payroll Regulations

Each country has unique tax laws, social security contributions, and labor regulations that businesses must adhere to when processing payroll.

2. Multi-Currency Salary Payments

Employees in different countries must be paid in their local currencies, which can be complicated due to fluctuating exchange rates and banking regulations.

3. Taxation and Withholding Compliance

Companies must accurately calculate and withhold payroll taxes based on country-specific tax policies to avoid fines and legal issues.

4. Data Security and Payroll Confidentiality

With strict data protection laws such as GDPR, businesses must ensure that employee payroll data is securely managed and compliant with international privacy standards.

5. Payroll Processing for Remote and Hybrid Employees

The rise of remote work means businesses must navigate payroll regulations in multiple jurisdictions, including contractor payments and benefits compliance.

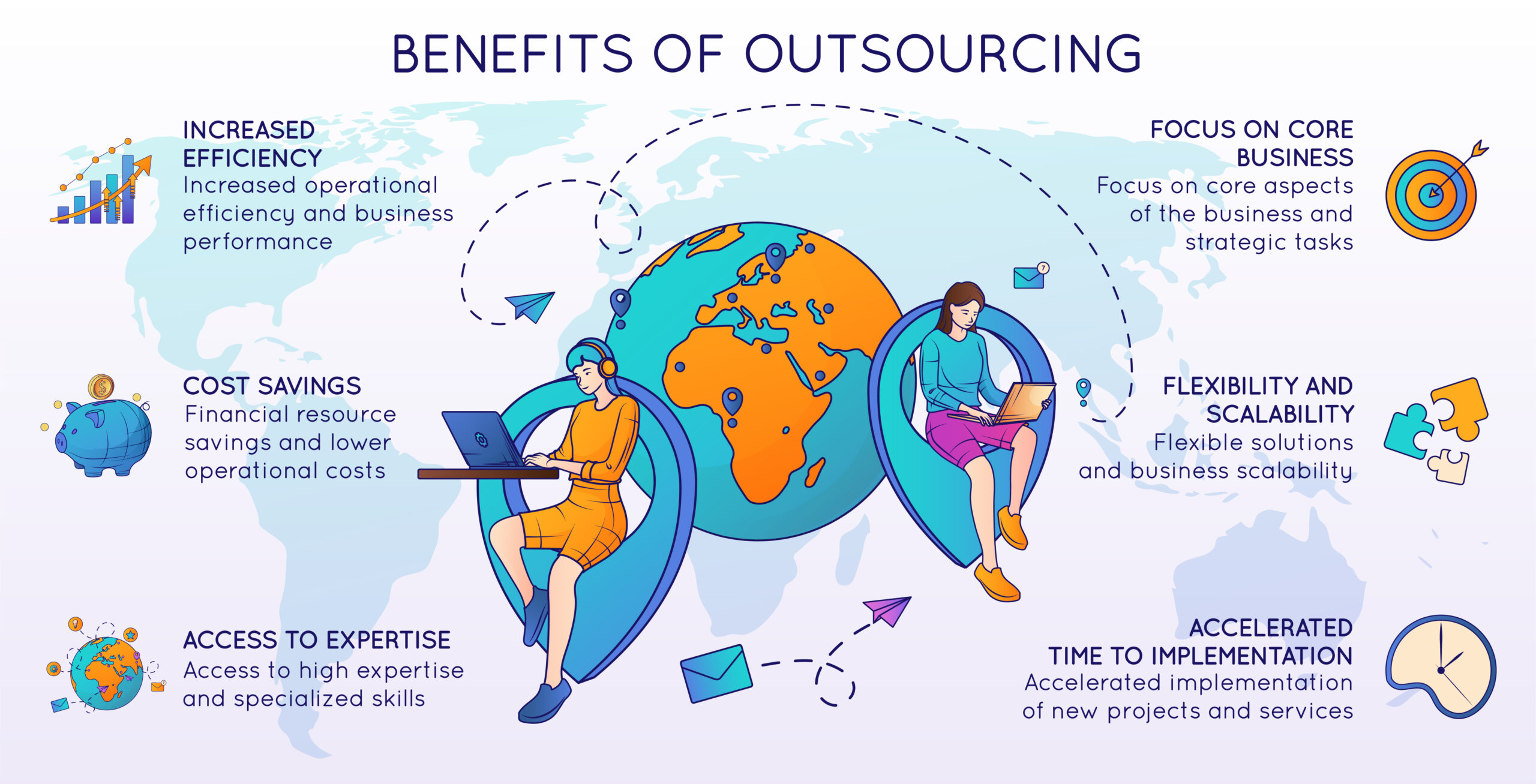

How Global Payroll Solutions Help Businesses Expand Internationally

1. Ensure Compliance with Local Payroll and Tax Regulations

A global payroll solution automates tax calculations, social contributions, and compliance reporting, reducing legal risks and administrative burdens.

2. Simplify Multi-Currency Payroll Processing

These solutions handle salary conversions, manage exchange rate fluctuations, and ensure timely payments in different currencies.

3. Streamline Payroll for Global Remote Workers

Companies can efficiently pay remote employees and contractors while maintaining compliance with local labor laws and tax requirements.

4. Reduce Administrative Workload and Errors

Automating payroll processes eliminates manual errors, ensuring accuracy in salary calculations, tax deductions, and compliance filings.

5. Improve Workforce Satisfaction and Retention

Employees receive accurate, timely payments, and companies can offer localized benefits, enhancing job satisfaction and retention.

Conclusion

Global payroll solutions are essential for companies expanding internationally. They simplify compliance, enhance efficiency, and ensure that employees are paid correctly and on time. By leveraging a reliable global payroll system, businesses can focus on growth while minimizing payroll-related risks.