As businesses expand internationally, managing finances across multiple countries becomes more complex. Different tax laws, financial regulations, and currency fluctuations make global accounting a challenge. Without the right strategies, businesses risk compliance issues, financial mismanagement, and inefficiencies. In this blog, we’ll explore best practices for global accounting to ensure smooth financial operations.

Key Challenges in Global Accounting

1. Compliance with Local Regulations

Each country has unique financial reporting standards, tax requirements, and regulatory frameworks. Non-compliance can result in penalties, fines, or even operational shutdowns.

2. Multi-Currency Transactions and Exchange Rate Fluctuations

Operating in multiple countries means dealing with different currencies. Exchange rate fluctuations can impact financial statements and profitability.

3. Taxation and Cross-Border Transactions

International tax structures, including VAT, withholding tax, and transfer pricing, require careful management to avoid double taxation and ensure tax efficiency.

4. Financial Reporting and Auditing

Businesses must adhere to international accounting standards such as IFRS or GAAP while ensuring accurate and timely financial reporting.

5. Managing Payroll and Employee Compensation

Different labor laws affect payroll taxation, benefits, and statutory deductions. A global payroll solution ensures compliance with country-specific payroll regulations.

Best Practices for Global Accounting

1. Implement a Unified Accounting System

Using cloud-based accounting software that integrates global financial data helps businesses maintain accuracy, transparency, and efficiency.

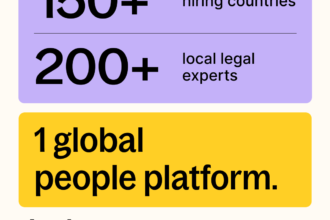

2. Work with Local Accounting Experts

Partnering with local accountants or financial consultants ensures compliance with tax laws and financial reporting requirements in each country.

3. Automate Currency Conversion and Financial Reporting

Multi-currency accounting systems help businesses manage exchange rate fluctuations, reducing the risk of financial discrepancies.

4. Standardize Financial Policies Across Regions

Developing consistent financial policies for expense management, invoicing, and reporting simplifies operations and ensures better control.

5. Stay Updated on Global Tax Regulations

Regularly monitoring tax law changes and leveraging tax optimization strategies help businesses minimize liabilities and avoid compliance risks.

6. Outsource Financial and Accounting Services

Outsourcing accounting and tax compliance to global financial experts helps businesses focus on core operations while ensuring regulatory compliance.

Conclusion

Effective global accounting requires a combination of technology, compliance expertise, and strategic financial planning. By adopting best practices such as automation, local compliance partnerships, and multi-currency accounting, businesses can scale globally while maintaining financial accuracy and efficiency.