Expanding internationally comes with significant tax compliance challenges. Each country has unique tax regulations, corporate tax rates, withholding tax rules, and reporting requirements. Businesses operating across multiple jurisdictions must navigate these complexities to avoid penalties, maintain compliance, and optimize their tax structures. In this blog, we’ll explore the key tax compliance challenges global businesses face and the best strategies to manage them effectively.

Key Tax Compliance Challenges for Global Businesses

1. Corporate Tax Variations Across Countries

Every country has its own corporate tax rates and rules, which can significantly impact business profitability. Companies must carefully plan their tax strategies to comply with local laws while optimizing their tax liabilities.

2. Withholding Taxes and Cross-Border Payments

Withholding tax rates on dividends, interest, and royalties vary by country. Understanding tax treaties and exemptions can help businesses reduce tax burdens on cross-border transactions.

3. VAT, GST, and Sales Tax Compliance

Different countries have varying rules for Value-Added Tax (VAT), Goods and Services Tax (GST), and sales tax. Businesses must register for these taxes in multiple jurisdictions and ensure proper reporting and remittance.

4. Transfer Pricing Regulations

Multinational companies must comply with transfer pricing rules to ensure that intercompany transactions are conducted at fair market value. Failure to comply can result in tax audits and penalties.

5. Permanent Establishment (PE) Risks

A company may unintentionally create a taxable presence (PE) in a foreign country by hiring local employees or conducting business activities. Understanding local PE laws is crucial to avoid unexpected tax liabilities.

6. Tax Filing and Reporting Requirements

Each country has different tax filing deadlines and reporting formats. Keeping track of these requirements across multiple jurisdictions is essential for compliance.

Strategies to Ensure Global Tax Compliance

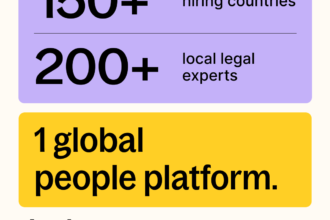

1. Partner with Local Tax Experts

Working with tax professionals in each country ensures accurate tax filings and compliance with local regulations.

2. Implement a Centralized Tax Compliance System

Using tax compliance software helps businesses track tax obligations, generate reports, and automate filings across multiple countries.

3. Take Advantage of Tax Treaties

Understanding and leveraging Double Taxation Avoidance Agreements (DTAA) can help businesses minimize tax liabilities on international income.

4. Conduct Regular Tax Audits

Internal tax audits help identify compliance gaps, mitigate risks, and ensure all tax obligations are met on time.

5. Use Employer of Record (EOR) Services for Compliance

An EOR can handle tax withholdings, payroll compliance, and employment tax obligations in different countries, reducing the risk of non-compliance.

Conclusion

Tax compliance for global businesses is complex, but with the right strategies, companies can ensure smooth operations while minimizing risks. By working with tax experts, leveraging compliance software, and staying updated on regulatory changes, businesses can successfully navigate international tax obligations and focus on global expansion.