As businesses expand globally, managing financial operations across multiple countries becomes increasingly complex. Different tax regulations, compliance requirements, and currency fluctuations can create challenges for finance teams. Financial outsourcing has emerged as a strategic solution to streamline multi-country operations, reduce costs, and ensure compliance. This blog explores the benefits, challenges, and best practices for financial outsourcing in global business operations.

Why Financial Outsourcing is Essential for Global Businesses

1. Compliance with Local Tax and Accounting Regulations

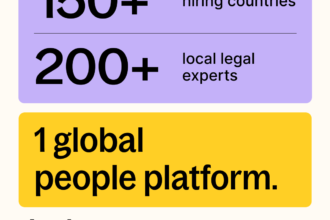

Each country has its own tax laws, corporate reporting standards, and financial regulations. Outsourcing financial operations to experts ensures adherence to local legal requirements and minimizes the risk of penalties.

2. Cost Efficiency and Scalability

Hiring and maintaining in-house financial teams in multiple countries can be expensive. Outsourcing allows businesses to scale financial operations without the burden of recruiting and training local talent.

3. Multi-Currency Transactions and Exchange Rate Management

International businesses deal with multiple currencies, requiring effective exchange rate management to minimize financial risks. Outsourced financial teams handle multi-currency payments, invoicing, and reconciliation efficiently.

4. Standardized Financial Reporting and Data Accuracy

Maintaining consistent financial reporting across different jurisdictions is crucial for decision-making. Financial outsourcing firms use advanced reporting tools and analytics to provide accurate financial insights.

5. Focus on Core Business Functions

By outsourcing financial tasks such as payroll, tax compliance, and accounts management, companies can redirect internal resources toward strategic growth initiatives.

Challenges in Financial Outsourcing & How to Overcome Them

1. Data Security and Confidentiality

Outsourcing financial operations involves sharing sensitive data. Companies must work with outsourcing partners that have robust cybersecurity measures and comply with data protection laws such as GDPR.

2. Communication and Coordination Across Time Zones

Global teams operate across different time zones, which can lead to delays in financial processes. Clear communication channels and cloud-based financial management systems help ensure smooth coordination.

3. Regulatory Changes and Compliance Risks

Tax laws and financial regulations frequently change. Partnering with experienced financial outsourcing firms that provide regulatory updates and proactive compliance management helps mitigate risks.

4. Integration with Existing Systems

Outsourced financial operations should seamlessly integrate with a company’s internal accounting and ERP systems. Choosing a provider that offers API integration can enhance efficiency and data accuracy.

Best Practices for Successful Financial Outsourcing

- Choose a Trusted Financial Outsourcing Partner: Work with a firm that has experience in your target markets and offers compliance expertise.

- Leverage Technology and Automation: Use cloud-based financial management tools to streamline processes and improve accuracy.

- Establish Clear Service Level Agreements (SLAs): Define performance expectations, response times, and compliance requirements in outsourcing contracts.

- Maintain Oversight and Regular Audits: Even with outsourcing, companies should monitor financial operations and conduct regular audits to ensure transparency.

Conclusion

Financial outsourcing is a powerful strategy for managing multi-country operations efficiently. By leveraging expert financial services, businesses can navigate compliance challenges, reduce costs, and enhance financial accuracy while focusing on core growth strategies. With the right outsourcing partner and technology, companies can achieve seamless financial management across borders.