Expanding your business globally is an exciting opportunity, but it comes with significant compliance risks. Every country has unique labor laws, tax regulations, and employment requirements that businesses must follow. Failure to comply can lead to legal penalties, employee disputes, and reputational damage.

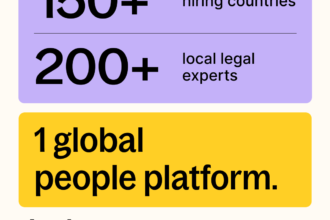

An Employer of Record (EOR) helps companies manage these compliance challenges while hiring internationally. In this blog, we explore the key compliance risks of global hiring and how an EOR mitigates them.

1. Key Compliance Risks in Global Hiring

A. Misclassification of Employees

Many companies misclassify employees as independent contractors to save costs. However, governments are cracking down on misclassification, leading to fines and legal action.

🔹 Risk: Heavy penalties, back pay requirements, and legal disputes. 🔹 EOR Solution: Ensures correct worker classification according to local laws.

B. Violation of Local Labor Laws

Employment laws vary by country, covering aspects such as minimum wage, termination policies, working hours, and leave policies.

🔹 Risk: Non-compliance can lead to employee lawsuits and financial penalties. 🔹 EOR Solution: Keeps businesses updated on evolving labor laws and ensures full compliance.

C. Payroll and Tax Errors

Each country has unique payroll regulations, tax rates, and reporting requirements. Errors in tax filings or late salary payments can lead to audits and financial losses.

🔹 Risk: Legal fines, audits, and employee dissatisfaction. 🔹 EOR Solution: Manages payroll, tax withholdings, and compliance filings accurately.

D. Work Visa and Immigration Issues

Hiring foreign employees requires work permits and visas, with strict compliance regulations. Violating immigration laws can lead to deportation and business restrictions.

🔹 Risk: Visa denials, penalties, and inability to retain global talent. 🔹 EOR Solution: Sponsors work visas and ensures proper documentation.

E. Data Protection and Employee Privacy Regulations

Countries enforce strict data protection laws like GDPR in Europe and PDPA in Singapore. Mishandling employee data can lead to lawsuits and data breaches.

🔹 Risk: Fines, legal liabilities, and loss of trust. 🔹 EOR Solution: Implements secure HR and payroll systems to protect employee data.

2. How an Employer of Record (EOR) Ensures Compliance

An EOR takes legal responsibility for employment, ensuring full compliance with:

- Local employment laws to avoid fines and disputes.

- Payroll and tax regulations for accurate salary processing.

- Contract management to align with country-specific requirements.

- Employee benefits and social contributions as per legal mandates.

- Work permits and visa regulations to hire international talent legally.

3. Benefits of Using an EOR for Compliance Management

✅ Risk Reduction: Avoid costly legal mistakes and penalties. ✅ Faster Market Entry: Hire globally without waiting for entity registration. ✅ Legal Expertise: Ensure labor law compliance in every country. ✅ Efficient Payroll Management: On-time payments with tax compliance. ✅ Focus on Business Growth: Reduce HR administrative burdens.

Conclusion

Global hiring comes with complex compliance risks, but an Employer of Record (EOR) simplifies the process. By ensuring legal compliance, payroll accuracy, and risk management, businesses can expand internationally with confidence.